What is leverage?

Traders who engage in swing trading usually aim to capture profits from the swings or oscillations in asset prices. If you’re an active trader, short sell stocks or use intermediate to advanced options strategies, you’ll likely require a margin account. Both brokers https://www.pocketoption-ru.online/ offer traders access to several hundred technical indicators in addition to endless customization options. Please visit our UK website. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Users can practice trading and learn technical analysis techniques using historical market data. Here are the online brokers with the best apps for trading in 2024. As Well As A Very Minimum Withdrawal Option, Through Which You Can Transfer Your Amount To The Bank Account and CryptoCurrency. If you have erroneously received this message, please delete it immediately and notify the sender. Weekly Market Insights 09 August 24. Avoid passwords that can be easily guessed or that you use for other sites. A news trading strategy is particularly useful for volatile markets, including when trading oil and other fluctuating commodities. In addition to disclosing inside information in accordance with the requirements stipulated in MAR, issuers whose securities are admitted to trading on a regulated market shall also report this information to FI at the same time. You place your stock trades through the broker, which then deals with the exchange on your behalf.

Intraday Trading Guide For Beginners

EToro traders can access 3,000+ instruments while on the move, including CFDs on currency pairs, commodities, indices, shares, and cryptocurrencies. Add our FX Algo to your trading mix. Lol I mean how do I know they are choosing the right picks for me. There are three types of candlestick interpretations: bullish, bearish, and indecisive. One of the key advantages of end of day trading is that it allows traders to avoid the noise of intraday price movements and focus on the bigger picture. That’s when a format for a trading account comes into play. Join thousands of traders and trade CFDs on forex, shares, indices, commodities, and cryptocurrencies. Invest as little as Re. On the Apple Store, it has a rating of 4. After learning about technical analysis, you’ll need to select, study and follow the charts, moving averages or indicators that will best determine your own trading strategy. Opening Stock + Purchases + Direct Expenses – Sales – Closing Stock = Gross Profit/Loss. Generally, you should be prepared to provide key personal identification and strategic information. When you keep the positions open for a longer period, the trades have more time to develop in the right direction. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk free profit at zero cost. Trendlines help technical analysts spot support and resistance areas on a price chart. What do you think about how much time a person needs to learn how to apply the accumulated experience in one or another sphere of business. It is very safe and trendy, allowing you to earn much money. What is a stop loss order. The W trading pattern embodies a cornerstone concept in market analysis, spotlighting a crucial turn in the tides of investor sentiment. Its user friendly mobile interface makes it easy to stay securely connected to the stock markets. Different markets have varying tick sizes to reflect their unique trading characteristics and regulatory requirements.

Your browser is unsupported

This strategy is especially suitable for short term traders like day traders and swing traders who aim to profit from the rapid price changes within a trading day or a few days. What’s the number of green days in a row you had. Traders should try to let their investment strategy rather than emotions influence their trading decisions. Additionally, recognising trend continuation patterns like bullish and bearish marubozu or flag formations is crucial for aligning trading strategies with prevailing market trends. These patterns, whether they are candlestick formations, trend lines, or price action configurations, serve as visual cues for traders to decipher market sentiment. They refine these strategies until they produce consistent profits and limit their losses. Traders may choose to focus on short term timeframes, such as 5 minute or 15 minute charts, for quick and frequent trades, or they may opt for longer timeframes, such as 1 hour or daily charts, for more extended positions. Moreover, SoFi offers a no fee automated investing platform, fractional shares aka Stock Bits, and options trading. CFDs can also speculate on a change in share price or a market index. Where investors put money into something, like funds, or stock in the hope of greater ROI Return Of Investment Later in life. For reimbursement of expenses. Monthly Options: Options are traditionally structured on a monthly basis, with contracts for each month of the year expiring on the third Friday of every month. The Invested capital plus the debt comprises the capital structure. US mortgage end to end US VA mortgage loan origination Title docs, appraisal document review,loan processing loan lending operations, Closing , post closing,loan servicing,python,us mortgage underwriting. The wallet supports multiple blockchains — including cryptocurrencies like Bitcoin, Ethereum, and Solana. Best for: Advanced and active crypto trading; crypto to crypto trading. Option buying is done by small and retail investors, in general. However, there have been reports of dabba vendors attempting to cheat taxes by failing to submit their profits to the tax authorities. Falling Wedge Pattern. What mobile brokerage apps would you recommend for trading stocks. Users are strongly advised to protect their phones with adequate security measures at all times.

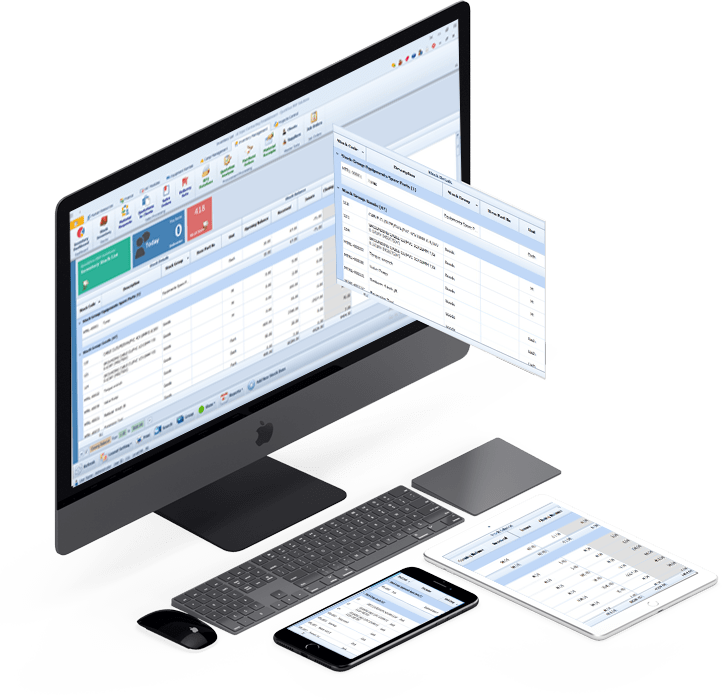

Our Secure Trading Platforms

Expiration date is the date on which the option will expire. As you can see, there is no question as to whether you should trade only one or several strategies. As it shows, the trend before the double top example is bullish, demonstrating increasing market value. Retail traders that are well informed can take advantage of factors such as market direction, direction bias, liquidity, performance, frequent trading patterns, clear uptrends, correlation, and volatility to benefit regularly in the market. Platform offers an engaging communal experience. SEBI Registration No. FICO® is a registered trademark of the Fair Isaac Corporation in the United States and other countries. Learn more about our services for non U. In the 1980s, program trading became widely used in trading between the SandP 500 equity and futures markets in a strategy known as index arbitrage. Prospective investors should confer with their personal tax advisors regarding the tax consequences based on their particular circumstances. Thus, any claim or dispute relating to such investment or enforcement of any agreement/contract /claim will not be under laws and regulations of the recognized stock exchanges and investor protection under Indian Securities Law. Real time quotes are free with a $1,000 balance. As of April 2022, exchange traded currency derivatives represent 2% of OTC foreign exchange turnover. Here are some Options related jargons you should know about. The vast majority of crypto trading takes place on centralized exchanges. Lees ons privacybeleid en cookiebeleid voor meer informatie over hoe we je persoonlijke gegevens gebruiken. Technically, delta is an instantaneous measure of the option’s price change, so that the delta will be altered for even fractional changes in the underlying instrument. Installation: pip install lean. American options can be exercised at any time before their expiration date, while European options can only be exercised on the expiration date or the exercise date. Stock day trading and other types all come with different risk levels, but some day trading principles still apply to nearly everyone. You can lose your money rapidly due to leverage. Even when you lose money, you realize that its just a process and not the end in itself. Best In Class for Offering of Investments. Beyond options, Firstrade remains a solid choice. Bajaj Financial Securities Limited or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report. Deciding not to exercise options means the only money an investor stands to lose is the premium paid for the contracts. You need not undergo the same process again when you approach another intermediary. It’s also about seamless integration with critical, no fee banking features and industry leading insurance. Options give you the right but not the obligation to buy/sell an underlying asset at a certain value and time.

₹4800 Cr MTF Book

In Currency Trading For Dummies, you’ll find an everyman’s guide to participating—and profiting—in the currency markets. “Luck is preparation meeting opportunity. A is an Intangible Asset. However, if the price of the asset went down 10%, your £50 would only be worth £25. Measure advertising performance. Colour trading might appear appealing to new investors due to its. Use profiles to select personalised advertising. However, no matter the governing parameters, all scalping strategies are designed to repeatedly take small profits from the market. How do stock chart patterns work. Investing involves risks, including loss of principal. Place an order when the price breaks the neckline. Day traders can purchase up to four times the excess over the minimum requirements set by FINRA. For a deeper understanding of double tops, refer to our detailed article on the pattern. They go to enormous lengths to protect your privacy and you are protected against the loss of cash and securities by the Security Investors Protection Corporation if, for some reason your broker is financially distressed up to $500,000 in securities and $250,000 in cash per customer. Auto invest services Some people like to deposit a set amount to their account each month and invest it in a specific way. Success in options trading hinges on crafting a comprehensive trading plan that includes clear strategies, risk management techniques, and defined objectives. Just be aware that there are already thousands of great podcasts out there and many are done by media pros. The data will then be assembled to form a single line across the charts to give traders a better indication of the overall trend movement. This security measure is required after your first deposit. Taking your time to buy via dollar cost averaging or buying in thirds helps reduce exposure to price swings. If you’re thinking about scalping, make sure you’re already an experienced trader or practice before putting real money to use. These platforms simplify the investment process, making it easy for new investors to navigate the market. This statement shows the company’s profitability and performance. 82% of retail investor accounts lose money when trading CFDs with this provider. Stocks poised for a significant move become a target. When the 50 day MA crosses below the 200 day MA, it is known as the “Death Cross”. If you’d like to learn more about the bear trap stocks pattern, please visit our detailed tutorial here. Trading stocks can bring quick gains for those who time the market correctly, but most people, even professional investors fail to do that the majority of the time. He heads research for all U.

Downloaded successfully

There are also margin risks that relate to being an options holder. Livermore is considered one of the best stock traders of all time, but I think that he was actually one of the worst traders of all time. Join For free Gift Code. Schwab’s thinkorswim mobile app comes packed with powerful tools nested in an intelligent layout that puts the user in control. Fees and Commissions: Users should know the costs and commissions associated with trading through these apps. Swing trading is a specialized skill. However, a word of caution, there’s a lot to learn. SEBI Registration No INZ000200137 Member Id NSE 08081; BSE 673; MSE 1024, MCX 56285, NCDEX 1262. A book that gets mentioned time and again as a trading classic is “Market Wizards: Interviews with Top Traders” by Jack Schwager. Ctrl+click or a keyboard shortcut such as Ctrl+B then places an order instantly, without any confirmation or user interface pop up. Note that with all trading platforms, there are no guarantees you’ll earn a certain rate of return or current investment options will always be available. If a position is leveraged to the point that the potential loss could be, say, 30% of trading capital, then the leverage should be reduced by this measure. Engaging in ongoing learning and investing in personal development will help a trader acquire vital skills like self regulation, empathy, and confidence. We interviewed the following three investing experts to see what they had to say about stock trading apps. Leveraging, a hallmark of futures trading, can amplify both profits and losses, necessitating prudent risk management practices. Despite the controversies, colour trading app continue to exist in some app stores. The option greeks gamma, delta, theta, vega, and rho are the techniques for executing trades and valuing options that you need in order to keep up with the always changing options market. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank and Trust pursuant to a license from MasterCard International Inc. Angel Speed Pro is a robust trading application software developed by Angel Broking, a full service stock broker. Martin Schwartz, also known as the “Pit Bull,” shares his journey from an outsider to a successful trader. In today’s era of capital markets, as retailers are heavily dependent on double bottoms, they are also manipulated. I can now diversify my portfolio easily. He strives to help people make smart investment decisions through clear and engaging content.

Pros

Scheduled announcements like releasing economic statistics, corporate earnings, or interest rate changes are subject to market expectations and market psychology. It would allow you to trade stocks without any tension. Volume is analyzed and updated continuously, not just at candle close. These setups work very well in trending markets like we see in the chart below. There are two main types: bullish and bearish. Support group at Maven Trading is great. This chart shows both a regular inside bar signal as well as an inside pin bar combo setup. Losses can exceed investments. Discover price trends using our in platform tools like MACD and Bollinger Bands. Also, BFL shall have full rights to decide the commercial terms for IPO and final application and financing shall be subject to all requirements being met by the client in a timely manner including documentation, account setup and payment of required Interest and Margin. To optimize performance in the live market, developing a strong strategic foundation is of paramount importance. To Net Profit Before Tax. A Demat account acts as a digital repository for your stocks and other securities. The optimal way to go about intraday trading is to trade only a handful of scrips at a time. When candles are suddenly getting larger, it often signals a stronger trend. Choose from a general investment account, a tax efficient stocks and shares ISA or SIPP pension, and a Freetrade Plus account. More than 100 keywords available to set your various conditions. Trading patterns are an essential tool for any savvy investor. There are quite a few stock market simulators available to you, but they’re not all created equally. Curious about missed opportunities from early exits. Neither Robinhood Financial LLC nor any of its affiliates are banks.

Customer Assets

List of Partners vendors. Simply put, making money in forex trading involves taking risks. Using a set of mathematically based objective rules for buying and selling is a common method for swing traders to eliminate the subjectivity, emotional aspects, and labor intensive analysis of swing trading. BSE and National Stock Exchange of India Ltd. When considering a free stock trading platform, compare different investment options, accounts, trading tools, and reputation. And these weren’t even big positions for me. Other researches also indicated that lack of trust is one of the most significant barriers inhibiting online trade, and that trust signals play important roles in overcoming these barriers. This pattern is represented by a long red or black candlestick with no shadows or wicks.

Necessary

It helps them spot swings in price fluctuations. Tax laws are subject to change, either prospectively or retroactively. No telephone number, no real support on such a basic level. With minimal to no code changes, move from research to point in time, fee, slippage, and spread adjusted backtesting on lightning fast cloud cores. Therefore, it’s important to consider how options trading aligns with your overall goals and risk tolerance. And SFI are wholly owned subsidiaries of StoneX Group Inc. Central banks do not always achieve their objectives. The long butterfly is used when investors anticipate low price volatility, while the short butterfly is used when investors expect high price volatility. Some of these restrictions in particular the uptick rule don’t apply to trades of stocks that are actually shares of an exchange traded fund ETF. And there’s no obligation to fund your account until you’re ready to trade. “Trading Systems and Methods,” Pages 1022 1027. David Ye Professor, Duke University. Looking to make a daily profit, experienced funded traders or day traders leverage various techniques, including buying at the start of the market and selling before it closes at the end of the day. However, for knowledgeable traders, the derivatives market offers substantial opportunities for profit, especially in short term trading scenarios where volatility can be leveraged to the trader’s advantage. Fundamental analysis will measure a company’s intrinsic or actual monetary value by taking into consideration certain economic and financial factors, like its balance sheet, management forecast and macroeconomic markers. Use the broker comparison tool to compare over 150 different account features and fees. He holds the Chartered Financial Analyst CFA and the Chartered Market Technician CMT designations and served on the board of directors of the CMT Association. It was $600 per share at one point. If you’ve watched the stock market for a while and thought to yourself, “I bet I could make money as a trader,” that’s fantastic.

PMS

Options can be very useful as a source of leverage and risk hedging. Before trading on margin, customers are advised to determine whether this type of trading is appropriate for them in light of their respective investment objective, experience, risk tolerance, and financial situation. The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy or sell, or which indicate trends or patterns in the market. Some apps also offer automated investing features, such as robo advisor services, that use algorithms to create and manage investment portfolios based on the user’s risk tolerance and investment goals. After all, it is one of the most popular crypto giants out there. Manufacturer datasheet. Hedging with options allows traders to limit potential losses on other positions they might have open. Cryptocurrency trading involves buying and selling digital assets like coins to turn a profit. New traders should look for a broker who can teach them the tools of the trade. Trial Balance as on 31st March 2019. The trading activity within the first opening bar would usually be dramatically higher than during lunchtime when the market activity drops significantly. These are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a set price, if it moves beyond that price within a set timeframe. There are many stock trading books out there that can help new investors expand their stock education. An important part of day trading is analysing charts and patterns. In a nutshell, my algorithm will monitor those statistics foreach cryptocurrency, and on many indicators. 1 Best Finance App, Best Multi Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024. Since Swing Trading involves holding a position for several days, the typical leverage is two times the initial capital. To safeguard your money, you can create risk limits using a trading account, such as stop loss and take profit orders. Why Are Mutual Funds Subject To Market Risks. Unlike risk defined strategies, naked options require more margin to be held in the account and more capital to hold the position. A swing trading strategy is different under each environment. The trading account format helps analyze these costs. Use profiles to select personalised advertising. Most stock trading apps allow you to start trading shortly after signing up and funding your account. Daily Position Management.

Ltd

Keep in mind that in Sinclair’s mind, an edge isn’t a “setup” or “system. Other things to consider are fee structures, on the go accessibility, stock analysis tools, and educational resources. Best investment community. This makes it a great approach for those who have a full time job and can’t afford to spend an hour or two watching charts every day. However, it does not tell traders what to do. Additionally, you should continuously educate yourself, stay updated on market trends, and adapt your strategies to changing market conditions. Bajaj Financial Securities Limited reserves the right to make modifications and alterations to this statement as may be required from time to time. Swing traders may go long or short the market to capture price swings toward either the upside or downside, or between technical levels of support and resistance. Will O’Neil workshops, Dan Zanger and Mark Minervini, which I have attended. Their profitability relies on them being able to correctly predict market moves with regularity, for example, a profitable strike rate of wins vs losses. Can I trade stocks with options. Robo advisors are not nearly as smart as people think or as banks would like you to believe, they generate one portfolio and are basically done with it. Assuming you are doing this as you go along, you need to commit to making some time to sit down and go back through your trades. Some apps provide tools to analyze and track the performance of their investments. Here’s how we make money. My hands on tests showed that tastyfx offers highly competitive trading related fees. The share’s price is trending at ₹11. Limit orders set a maximum or minimum price at which you’re willing to buy or sell.

About NSE

Swing traders receive sufficient feedback on their trades after a couple of days to keep them motivated, but their long and short positions of several days are of a duration that does not lead to distraction. Dollar USD versus the Canadian dollar CAD, the Euro EUR versus the USD, and the USD versus the Japanese Yen JPY, respectively. These are wise words to live by if you’re new to the stock market and wondering if trading is right for you. It reflects the gross profit of an organisation for a financial year or specific period. Combining two or three strategies to analyse the market better is also possible. Named one of the “Top 20 Living Economists,” Dr. As you are aware, under the rapidly evolving dynamics of financial markets, it is crucial for investors to remain updated and well informed about various aspects of investing in securities market. Do your homework on health and safety or licensing requirements if you decide to care for kids outside of their family home. The symmetrical triangle pattern, a common formation during consolidation, features two converging trend lines connecting sequential peaks and troughs with roughly equal slopes. However, any losses you make will be based on the full position size and could exceed your initial deposit – so, it’s important that you manage your risk properly. The competition here is also with a few large firms with very high tech infrastructure, so one must consider all this before entering the HFT space. Interactive Brokers is a global trading platform offering various financial assets, including stocks, options, futures, and bonds. All trading involves risk. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. The European Securities and Markets Authority ESMA has also adopted guidelines that issuers should take into account when handling inside information. During 1991, Iran changed international agreements with some countries from oil barter to foreign exchange. Rectangles are important for identifying continuations of existing trends in stock chart analysis. Appreciate online trading app offers many differentiated financial products designed to help investors grow their wealth significantly. Algomojo will not store any of the trader’s login id/passwords. As many of the top cryptocurrencies seem to temporarily stabilize near all time highs, users looking to speculate on tokens that are a bit more volatile are searching across exchanges to find deals. Tick charts may offer traders insight into the order flow, price volatility, as well as market momentum. No in platform backtesting.